What is UPI App: Unified Payment Interface of India

UPI is a payment system which facilitates the fund transfer between two bank accounts. This payment system works on the mobile platform. Sending money through the UPI app is as easy as sending a message. You are not required to give bank account details for the fund transfer through the UPI payment system. UPI is one of the most advanced method among all the digital payments.

Benefits of UPI

UPI is revolutionary. It will make the banking transaction a breeze. The RBI governor Rajan considers the launch of UPI as the Whatsapp moment.

- The UPI transfers the fund immediately. No restriction of holiday or working hours. The bank strike will also not affect the UPI payments.

- You do not require the bank account number and IFSC code of the recipient.

- You can transact from many bank account through a single UPI app.

- You are not required to wait up to 24 hours to send money to a new payee. Anyone would get money immediately.

- You can send bills and get money once the client approves it.

- You can use the Cash on Delivery without paying cash to the delivery boy. Just approve the bill and the delivery boy would get confirmation.

Read more about the UPI Benefits in a separate post

How UPI is Better Than IMPS

Till now I was using the IMPS method of fund transfer. It also transfers fund immediately, 24 x 7. But, UPI has some advantages.

To send the money through the UPI, you don’t need to know about the bank of the recipient. It is necessary in the case of IMPS.

To use the IMPS, you need the bank account number and IFSC code of the recipient.

Only through the UPI, you can ask for the payments through the banking channel. In fact, one touch would complete the payment. You would agree that this method of getting payment would have more success rate.

You can’t pay for online shopping through the IMPS. But UPI gives the easiest way of online payment.

Virtual Payment Address (VPA)

The UPI payment system does not use the bank account details of the recipient. But, there should be an accurate identification of the money recipient. Ultimately, all this convenience is fruitful if the money goes in right hands.

So, every user of the UPI apps must have a unique ID. This unique ID is called as the Virtual Payment Address (VPA). Now you can frown on this new headache of remembering the VPA. But, don’t worry. It is going to be very easy. It would be as easy as a mail ID.

Rather, It would be similar to the mail ID. For example vivek@icici, Rajan@bob, Sohan@axis

In fact, the App provider bank would allot the VPA to each user. You can choose the VPA similar to the mail address.

You can give this VPA to anyone to receive the money. The app would itself keep storing the VPAs of the person to whom you have transferred the money. It is like saving contacts in Gmail. So, from the next time you don’t even require VPA of the recipient.

What is the Charge of UPI Transfer

This is the next question in your mind. What is the extra cost of this extra facility?

Actually, You would be surprised, this extra convenience doesn’t come with the extra cost. Rather, It is too cheap to believe.

A transaction through the UPI would cost about 50 paisa. Whereas the fund transfer through the NEFT costs at least Rs 2.5. On the other hand, the IMPS fund transfer charges minimum Rs 5. The payment through the credit cards is much costly however the seller bears it. Now seller can pass the benefit of low cost of the transaction to you.

How To Get UPI APP

As I have told you in the beginning, the UPI payment system works only through the mobile application. Thus, you need a smartphone and internet data pack.

There are several UPI Apps. You can choose any of them. Each bank can launch its UPI-based APP. Banks can also incorporate UPI features into their existing mobile application. Such as, the ICICI Bank has incorporated UPI into the iMobile and Pockets. In fact, most of the banks have incorporated UPI in their existing mobile application.

Hence, if you already have an app of a bank, the update would be sufficient. Otherwise, you can download the UPI enabled app from the google play store. As of now, the UPI enabled apps are made only for android. Soon, the windows and iOS-iPhone customer would also enjoy this.

Which UPI App should I Download

There are several UPI apps in the Google Play store. There are many apps e. g BHIM app, SBI Pay, Pockets, HDFC Mobile, iMobile, Phonepe, PNB UPI etc. You may be confused. Which App should you download?

Should you download the UPI enabled app of your existing bank?

Actually, you are free to download any UPI enabled app. It can be from your bank or from any other bank. Choose an App which has the better interface.

However, I understand, that the obvious choice would be the app from your bank. But, don’t fret to try the other apps. You can start with the BHIM app. It is basic app and very simple.

How To Connect With Bank Account

The UPI has made the fund transfer very easy. But It is not a mobile wallet. Unlike the mobile wallet, you are not required to credit money into the UPI app.

Rather, the every fund transfers take place through your bank account. UPI app just acts as the link between you and your account. In other words, It has made the bank account transaction much easy and cheap.

So, to establish the link between you and your account, you have to connect UPI app to your bank account. This is a one-time process. It is done when you download a new UPI app. The UPI payment system gives you liberty to connect many bank account to one VPA. In fact, you can add all of your bank account to one UPI app. However, BHIM app, links only one account at a time.

While connecting to the bank account, you have to authenticate it through the card details and OTP. Once, your UPI app gets connected to a bank account, you can easily transfer fund to any person.

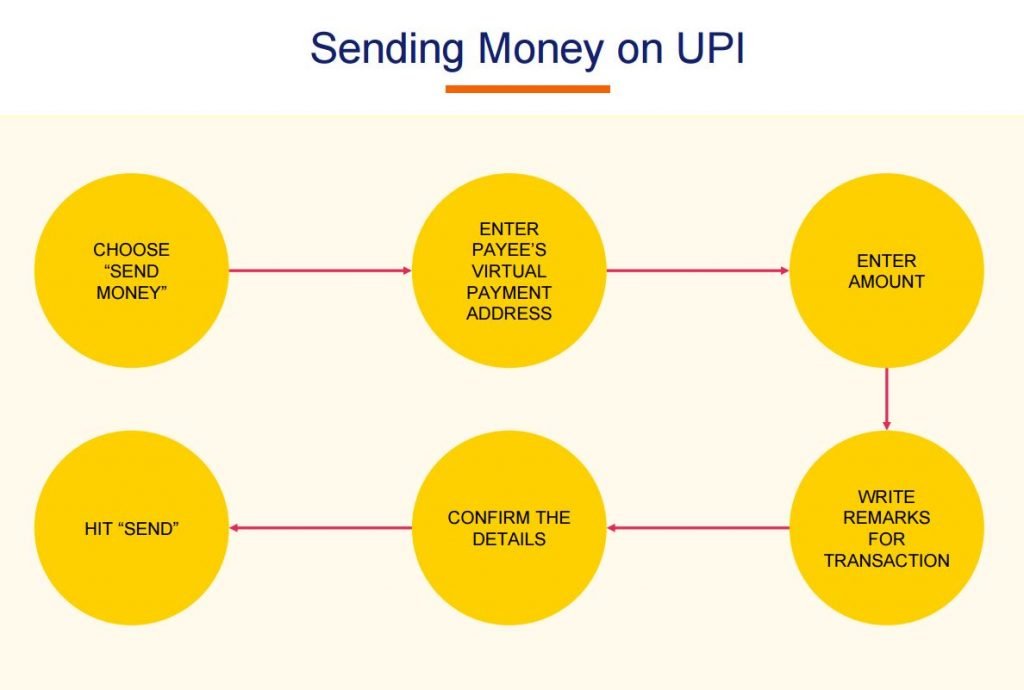

Send Money Through the UPI App

To send money through the UPI app, you have to go through these steps.

- Open the UPI app using the passcode. The Passcode is mandatory to open the app.

- Click on Send money. Choose the bank account from which you want to send money. If you have linked one account, you are not required to choose. When you send money using BHIM app, you would not see this option because it links only one bank account at a time.

- Select the receiver. You can choose a receiver using the VPA as well as the bank account number and IFSC code. So, it is better to get the VPA of money recipient.

- Add the VPA, if it is not already added.

- Enter the amount and send the money. Before the final confirmation, you have to enter the MPin. In the BHIM app it is termed as the UPI PIN.

- The money immediately gets credited to the account of the recipient.

Security of UPI Payment

The united payment interface is as much secure as internet banking or mobile banking. To transfer the money through the UPI app, one has to go through the two-factor authentication.

- To open UPI app, you have to give a PIN.

- To transfer the money, again you have to enter the MPIN or UPI PIN.

All other transactions also go through these two two-factor authentication.

Tutorial Video

The Niti Aayog has made a nice video to educate about the UPI. You should also watch this video for better understanding.

Conclusion

The UPI payment system is revolutionary. It makes the non-cash payment a very easy affair. Moreover, the NPCI is coming with new features of UPI. Soon the UPI 2.0 would be launched which has more flexibility, easy and wide reach. You should adopt this method of payment because it also reduces the black economy. To enjoy the benefits of UPI, you must try the one app from the best UPI apps of India.